China’s 20th Party Congress – Hope for the Economy or a False Dawn?

Hi all,

With China’s 20th Party Congress just around the corner, (beginning this Sunday October 16) today’s piece is about why its so important, and what we should be looking out for, from an economic point of view.

Again, thanks for reading and showing your support.

If you would like to show your support further, you can donate through my buy me a coffee link and it will help keep this newsletter sustainable, and so I know that you value the content I am providing:

https://buymeacoffee.com/januchanD

You can also show your support further by sharing or subscribing. Finally, any comments or feedback are most welcome and encouraged :)

There is a whole lot of attention on the upcoming China’s 20th National Party Congress. It is the biggest political event on the Chinese Communist Party’s (CCP) calendar, and it only happens every five years.

Special focus might be because Xi Jingping is widely expected to take on an unprecedented third term as President of China, after the term limits were scrapped at the 19th National Party Congress in 2017. A number of senior party officials are due to retire, so the make up of China’s key leadership team (the Politburo Standing Committee) will also be revealed and help provide a gauge of the policy direction for the country. Indeed, the Party Congress is known for outlining the CCP’s strategy over the next five years.

Given the current global geopolitical climate, China’s growing presence on the world stage and the major economic challenges that China is now facing, it seems like a more important time than ever to understand how China will tackle some of these issues.

When it comes to the economy and for investors, here is what we should be looking out for.

Zeroing in on Zero-covid

Let’s start with the elephant in the room – China’s zero-covid policy. At the time of writing, lockdowns and restrictions continue to be implemented across the country. While zero-covid remains in place, the risk of lockdowns across the country nullifies any other attempts to support the economy. The Party Congress was seen as a major obstacle to dropping the policy, but this is just one hurdle. Low natural immunity and vaccine hesitancy among the elderly continue to add another layer of difficulty in moving towards ‘living with the virus’. Nonetheless, news of growing public discontentment regarding the persistent lockdowns suggests the need for some exit strategy.

Recently, there have been steps to ‘open up’. Foreign students on resident visas are now allowed into the country, and quarantine requirements have reduced. Xi’s first overseas trip since the pandemic began is also another sign that attitudes towards covid could be shifting. That being said, a return to normalcy doesn’t seem likely to occur anytime soon, and probably well after the Congress. Moreover, any shift from the zero-tolerance policy will likely be gradual.

Bringing on the Stimulus

At some point, it will make sense to ease pandemic prevention measures. That will hopefully become clearer after the Party Congress is out of the way. Once that occurs it will pave the way for a pickup in economic activity. There is also greater scope for increased infrastructure investment. For the past year or so, rhetoric from officials has increasingly indicated concern about the economy and have implemented policies accordingly. Borrowing limits for local governments have increased for the purpose of infrastructure spending, and there have been some steps to encourage buyers back to the housing market.

How to Deal with the Property Crisis

Other measures have also been taken to provide emergency funding for developers and support for the financial system. Nonetheless, the measures continue to stop short of a ‘whatever it takes’ type of support which may be required to restore confidence within the property sector.

The government is in a bind because of the property sector’s size and the interconnectedness with the rest of the economy. Authorities may be forced to prop up the sector further or risk more severe consequences for the economy and the financial system. At the same time, there is a reluctance for a return to the old days of building up excesses within the property sector. Xi, policymakers and State media have repeatedly said that ‘houses are for living in, not for speculation’, so how the CCP finds this balance will be a key issue.

Now for the Bad News

For some years now, there has been awareness among Chinese official that China’s growth model of the past had to change. There was a need for sustainable high-quality growth and recognition that growth was being too reliant upon investment. The key growth driver had to shift towards consumption. In 2007, Wen Jiabao, Premier at the time, said that China’s growth was ‘unbalanced, uncoordinated and unsustainable’.

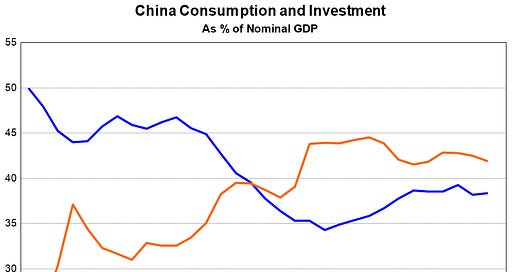

Taking a look at a chart of investment and consumption as a percentage of GDP, it appears that there has been little rebalancing that has occurred at all over the past five years. Household consumption remains at a low 40% of GDP and investment continues to take up over a 40% share.

So, what has happened?

Covid and the associated restrictions can be blamed for limiting a pickup in household spending over the past few years. Some commentators have pointed to the economy taking a backseat in policy priorities.

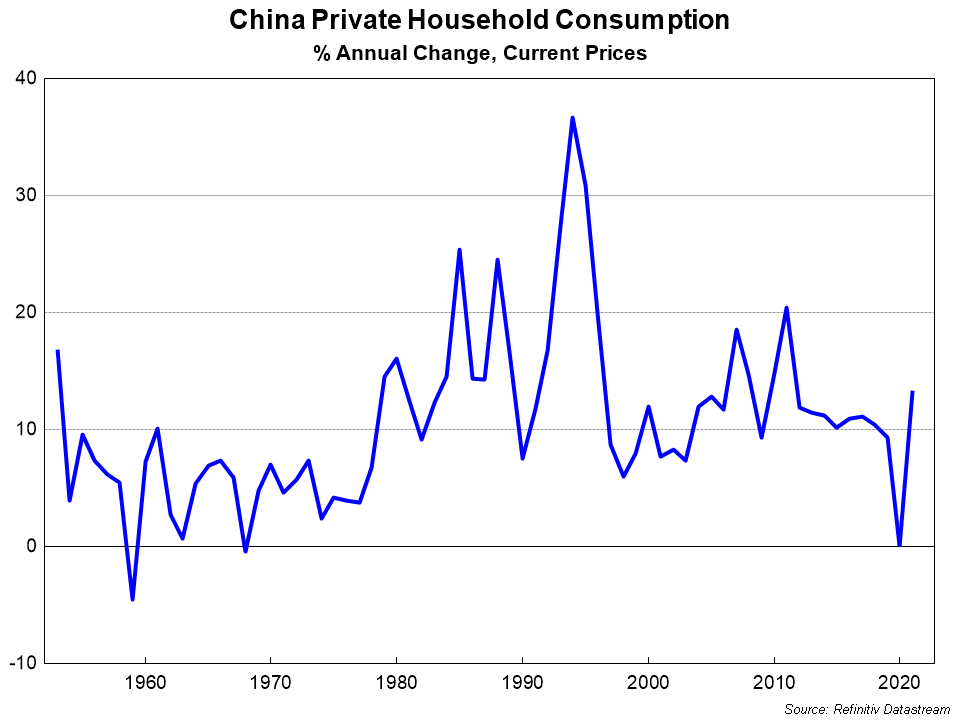

The hard truth is that whatever the policy prescription and whoever is in power for China, rebalancing means that its economic growth rate must slow. Given that household spending was already growing at a fast pace prior to covid, any rebalancing would likely mean less investment. And that would require weaker economic growth.

The steps towards clamping down on the property sector can be seen as some attempt towards rebalancing. However, there has still been minimal acceptance to see economic growth fall below a particular point. Consequently, there has continued to be a reliance on some form of investment spending to prop up the economy.

Over the past year, rhetoric from the government indicates it has once again turned towards infrastructure spending to support the economy. As well as the traditional road and rail projects, there is also a focus towards technology, supporting R&D, and information infrastructure.

Final Thoughts

There is a positive in that this renewed push for infrastructure will provide the economy with a near-term boost – once there is a move away from zero-covid. However, the malaise in the property sector is unlikely to go away anytime soon, even with government support. For commodity demand, the question is whether the infrastructure push is enough to offset the downturn within the Chinese property market.

Finally, the days of heady growth in China that we are used to seeing are numbered. For now, there continues to be a reliance on infrastructure to boost GDP. But after such high levels of investment for decades, increasingly these projects will likely be unproductive and add little economic value, even if they are directed towards different sectors of the economy. There needs to be a more serious re-think of China’s economic growth model that seemed to work for China in the past but will no longer serve it well for the future. How to deal with this dilemma will be ultimate challenge.