Confused About What Will Happen with Inflation?

Oh inflation. For so long, you lay dormant, so much so that policymakers were complaining that there wasn’t enough of it.

Last month has seen renewed concerns with regards to US inflation and has contributed to an abrupt pullback in sentiment and selloff in equity markets over recent weeks. Fed officials are still publicly advocating for more rate hikes, and some have indicated that the US Federal Reserve should have been more aggressive in raising interest rates.

So, just what is happening with inflation? How much should we be concerned?

But firstly, if you are liking this newsletter and want to show your support, you can donate through my buy me a coffee link available here:

https://buymeacoffee.com/januchanD

Also, if you haven’t already, and would like to subscribe, you can do so here:

***********************************************************************************************************

While the latest readings on inflation have exceeded expectations, there has been a clear shift downwards in inflation.

Monthly changes since the second half of 2022 have notably shifted lower.

It is also a similar story for PCE inflation, which spooked financial markets last week upon exceeding expectations.

Here’s that chart so you can see:

PCE inflation is the preferred measure for the US Federal Reserve, although you can see that over this past year has been more volatile.

Undoubtedly, January’s readings on prices have been on the high side. And the annual rate of inflation, at 6.4%, (or 5.4% for the PCE measure), is still too high for the US Fed’s comfort.

That being said, inflation is still very likely to come down, and there remains a risk it will come down quickly.

There are two reasons for this:

1) Leading indicators on inflation continue to suggest that it will.

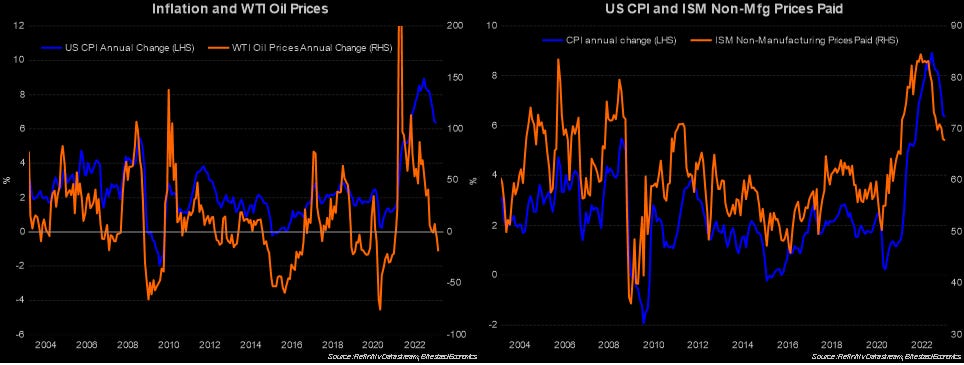

Last month, I presented six charts on inflation. And here they are again updated:

2) The second reason is the base effect. It essentially means that the annual rate of inflation will likely decline because the outsized increases in prices over the first half of 2022 will no longer be included in the calculation of annual inflation as we progress through 2023.

To see this in practice, if we assume that the average price increases of 0.3% per month were to continue, then the annual inflation would ease to around 3.5% by the middle of this year. The big gains of 0.7% in February 2022 and 1.0% in March 2022, and so forth, will fall out of the equation.

This effect is going to be most pronounced when it comes to energy prices. Around this time last year was when oil prices were soaring, and peaked around May at US$114 a barrel. If oil prices hold steady for the remainder of the year, that would equate to around a 30% decline from a year ago, bottoming out sometime in the middle of this year.

There is however, a lot of uncertainty surrounding the trajectory of price pressures – oil prices are no longer declining, although they aren’t rising significantly either. China’s re-opening adds to global demand, but it might also mean supply chains are less disrupted.

Regardless, to see inflation coming down isn’t going to be enough for the US Federal Reserve. It is going to want inflation to come down a little more (its target is at 2%) and confidence that inflation will stay down before they say enough on rate hikes. More than likely, that means a rising unemployment rate. Whether that means recession is absolutely inevitable? Well, that’s something we can discuss another time.