Can we stop worrying about inflation yet?

Inflation. It has been one of the dominant themes influencing financial markets over the past few years. It rose to multi-decade highs in most advanced economies and driven central banks to rapidly tighten monetary policy.

But firstly, I would like to thank you for reading and your support. For now, this newsletter is free, but to show your support further, you can subscribe here, or even upgrade to a paid subscription:

Or you can provide a one-off donation through my buymeacoffee link.

https://buymeacoffee.com/januchanD

Now, back to inflation.

As inflation has eased, the big story has hinged on whether the US Federal Reserve has reached the end of its tightening cycle.

Indeed, US inflation has weakened to the point that the Fed’s target of 2% is now within sight – monthly increases have averaged gains of 0.16% over the past three months. Indeed, if a similar pace of inflation were to persist, then inflation could hit the US Federal Reserve’s target by the middle of 2024.

But whether inflation can continue on this trajectory is a big “if”.

Before I go into why, you might recall charts on inflation which I presented towards the beginning of this year, available here: https://bitesizedeconomics.substack.com/p/confused-about-what-will-happen-inflation

At the time, all indicators were consistent in suggesting that inflation was set to weaken and that it could fall quite rapidly. Since the beginning of the year, inflation did in fact, weaken substantially from an annual rate of 6.4% in January to 3.3% in July.

Now, some of these indicators have turned the other way.

Firstly, commodity prices, particularly oil prices, have risen:

While the rise in oil prices does not automatically suggest that inflation is set to be a big problem once again, it does suggest that we could get a pop up in inflation.

And it isn’t just oil prices which are suggesting inflation could edge higher.

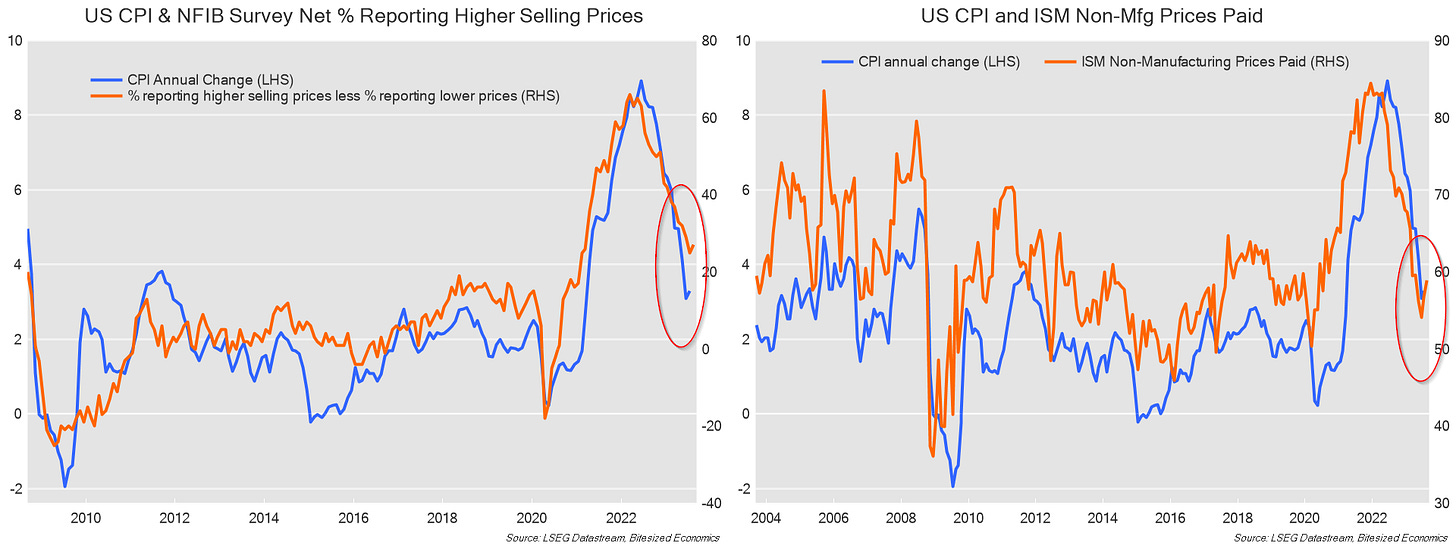

Business surveys are also pointing to higher prices, including both the NFIB Small Business Survey, and the ISM non-manufacturing survey. Moreover, the majority of firms that participate in these surveys are services, which suggests a pickup in services inflation could be on the cards as well.

It is services inflation which is the more persistent kind of inflation, that flows through to the economy more broadly.

So, could inflation be on the way back up?

Before coming to that conclusion, we need to look at the labour market, which is important for the longer-term outlook for inflation.

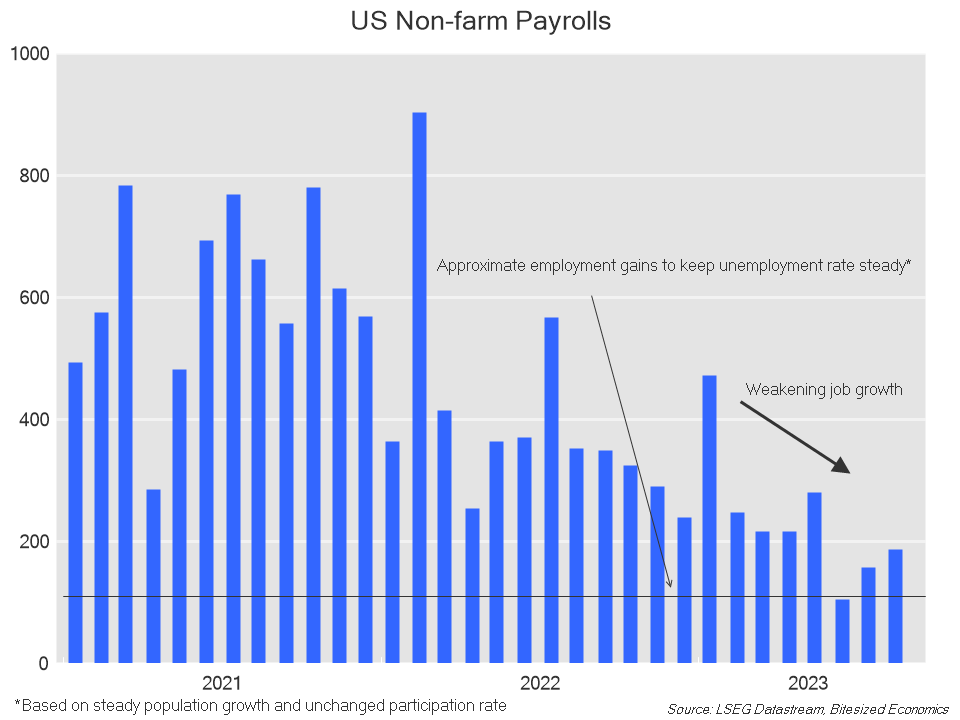

At first glance, it would seem like labour market conditions are supportive of a lower inflation story. There are signs that conditions are weakening – the unemployment rate has risen (now at to 3.8%) and employment growth has slowed.

But while employment growth has slowed significantly, it hasn’t slowed to a point where it suggests a rapid increase in the unemployment rate and a convincing slowdown in inflation. In fact, employment has slowed to a level which is suggestive of around a steady unemployment rate. The unemployment rate has only risen because of a rise in the participation rate to its highest since February 2020, just before the pandemic.

The fact that the participation rate has continued to rise has been a bit of a surprise. It means that are still more people wanting to enter the workforce – even though participation rates of prime age workers are above their levels before the pandemic.

We could see the participation rate rise further, but given that the prime age participation rate is already at a high level, that isn’t a strong possibility.

It does mean that job growth may need to slow a bit more if the unemployment rate is to increase further.

While some indicators suggest more slowing in the labour market, ie. job openings:

Other indicators suggest otherwise, and point to a slight strengthening in employment conditions:

Moreover, it isn’t just signs of inflation picking up, there have been signs that economic activity has improved of late according to recent surveys.

Of course, this kind of soft-landing scenario is what Fed Chair Jerome Powell was after – where employment would weaken sufficiently enough for a gradually rising unemployment rate and without a substantial slowing in the economy. But it’s not clear yet that employment will weaken sufficiently enough from here.

Moreover, a renewed pickup in economic activity would also equates to a more gradual fall in inflation, and even a risk that inflation picks up again.

Investors can’t have it both ways - a solid economy, and inflation falling rapidly.

Implications

So, what does all this mean for the inflation outlook and the Fed’s likely course of action?

Inflation has been on a downward trajectory and has slowed faster than expected. But we might get some stronger inflation readings in coming months.

It could mean we may not return to the Fed’s inflation target of 2% until the end of 2024.

That’s still sooner than the Fed’s latest projections (published in June), which don’t have inflation returning to 2% until beyond 2025. But that’s probably worse than what market participants are anticipating given that financial markets have around 80 basis points of rate cuts by the US Federal Reserve ‘priced in’ by the end of 2024. Some higher inflation outcomes could be supportive of the US dollar, and negative for bonds and equities.

For the Fed, it is close to a peak in interest rates, but another hike couldn’t be fully ruled out. Meanwhile, rate cuts are not likely on the cards any time soon, and any cuts in 2024 seems premature given that inflation may have only just reached the Fed’s target.

It might well be the case that the Fed can achieve the soft landing it hoped for. But that does also mean that inflation may not come down in a major hurry either.